1. Global Market Dynamics: From Niche to Mainstream

The global snus and nicotine pouch market is projected to grow from 27.7billionin2023∗∗to∗∗400 billion by 2030, driven by health-conscious consumers and regulatory breakthroughs like the FDA’s 2025 approval of ZYN’s 20 flavored products. Key growth drivers include:

- High Nicotine Efficacy: Oral absorption delivers blood nicotine concentrations 30% higher than cigarettes, satisfying heavy smokers while reducing exposure to tar and carbon monoxide by 95%.

- Geographic Expansion: While Scandinavia remains dominant (55% market share), Asia and the Middle East show potential, with 18% of Norway’s tobacco market already relying on smuggled snus.

- Youth Appeal: Flavored variants (e.g., tropical fruit, mint) contribute to 33% adoption among Gen Z in the U.S., raising debates about gateway risks.

2. Regulatory Milestones and Challenges

U.S. FDA’s Landmark Decision:

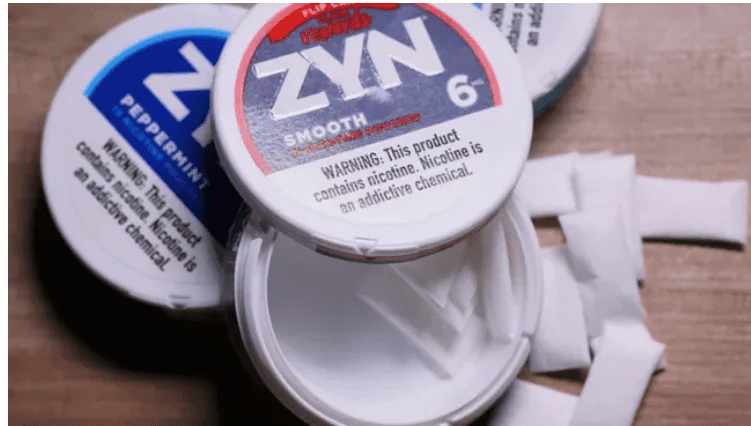

In January 2025, the FDA granted ZYN nicotine pouches Modified Risk Tobacco Product (MRTP) status, permitting claims like “reduced oral cancer risk” and multi-flavor marketing. This contrasts with the EU’s fragmented policies:

- Sweden’s Success: 5% smoking rate (vs. 23% EU average) and 41% lower lung cancer mortality linked to snus adoption.

- EU Ban Loopholes: Despite the 1992 Tobacco Directive prohibiting snus sales outside Sweden, smuggled products account for 18% of Norway’s market.

Emerging Markets:

- Asia’s Regulatory Gray Zone: China’s snus market remains unregulated, with online sales thriving despite ambiguous policies.

- Australia’s Strict Controls: Nicotine pouches require medical prescriptions, limiting accessibility.

3. Technological Breakthroughs Redefining User Experience

Next-Generation Product Design:

- Tobacco-Free Nicotine: Synthetic nicotine salts reduce carcinogens by 99%, aligning with the FDA’s 2025 safety benchmarks.

- Smart Delivery Systems: Microencapsulation technology enables 60-90 minute nicotine release, enhancing control over dosage and cravings.

- Eco-Conscious Packaging: Algae-based biodegradable pouches (launching in 2025) address environmental concerns, cutting plastic waste by 30%.

Medical Applications:

- Mental Health Trials: CBD-infused snus shows 40% anxiety reduction in PTSD patients, opening pharmaceutical partnerships.

- Smoking Cessation Tools: Clinical studies report 45-60% abstinence rates among snus users, outperforming traditional nicotine gum

4. Ethical and Public Health Dilemmas

Balancing Harm Reduction and Risks:

- Proven Benefits: Swedish data shows 52% of male smokers transitioned to snus, with 60% achieving long-term abstinence.

- Youth Protection Challenges: 25% of U.S. users aged 18-24 are first-time nicotine consumers, driven by menthol and fruit flavors.

Industry Accountability:

- Marketing Strategies: Brands like Velo and ZYN mimic e-cigarette tactics, sponsoring sports and social media campaigns to target adults while inadvertently appealing to minors.

- Policy Advocacy: Public health experts urge flavor bans and plain packaging to mirror Canada’s 4mg nicotine cap.

5. Investment Opportunities and Market Leaders

Key Players:

- Philip Morris International (PMI): Dominates with ZYN (55% U.S. market share) and 24.6% YoY growth in oral nicotine sales.

- British American Tobacco (BAT): Velo’s aggressive pricing (buy-one-get-one promotions) captures 15% global share.

Supply Chain Innovations:

- Synthetic Nicotine Production: Companies like Jin Cheng Pharma (200-ton annual capacity) and润都股份 lead in cost-effective, pharma-grade nicotine synthesis.

- Advanced Nonwoven Materials: Thermal-pressed fabric technology improves pouch comfort, with Chinese manufacturers accelerating R&D to compete with European suppliers.